Changing demographics of the welfare state shows the successes, failures, and trends of specific welfare programs and the welfare state.

On Jan 8th, 1964, U.S. President Lyndon Baines Johnson gave his presidential State of the Union address, introducing several programs for a war on poverty, sometimes considered to be an extension of President Franklin D. Roosevelt’s New Deal economic program and Four Freedoms speech.

At the time of Johnson’s address, the national poverty rate was 19%. “Our aim is not only to relieve the symptoms of poverty, but to cure it and, above all, to prevent it,” said President Johnson.

Four Pieces of Legislation Were Introduced in 1964 and 1965

- 1964’s Food Stamp Act (now known as SNAP) made food-related benefits permanent.

- 1964’s Economic Opportunity Act, which resulted in the Job Corps and VISTA program, as well as others, plus the OEO (Office of Economic Opportunity) — which originally spearheaded the war on poverty.

- 1965’s Social Security Amendments. This resulted in Medicare and Medicaid. Social Security benefits were also increased for eligible people, including retirees, widows, the disabled, and college-aged students.

- 1965’s Elementary and Secondary Education Act (ESEA), which was responsible for subsidizing school districts where poverty amongst students was high.

In the intervening time, how has the war on poverty fared? We look here at the some of the successes, failures and trends of specific welfare programs and some general statistics.

[Tweet “A family of 4 earning $11,925/yr in 2014 will get less aid than a family of 4 earning $47,700/yr”]

Recap of the War on Poverty and the Welfare State

Many of the original benefits programs announced during Johnson’s term in office are still in place, with additional programs created in later years and by other presidents. However, the OEO was taken apart by the Nixon administration, renamed in 1975 (under President Gerald Ford), then closed in 1981 (under President Jimmy Carter). See the Terminology section, below, for a list of acronyms.

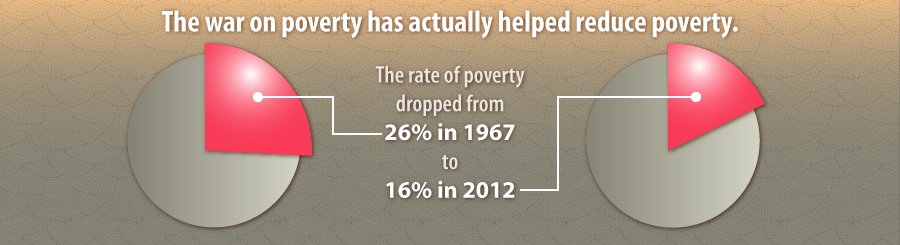

- While the poverty rate does not include all benefits post-transfer, the difference between the pre- and post-transfer poverty rate has increased each year during the 1967-2012 period — meaning that collectively, benefits are even more valuable in 2012 than in 1967.

- Programs like SNAP have helped lift millions out of poverty as well as significantly decreased extreme poverty (people living on less than $2/day for food expenditures).

- This is despite SNAP not being the largest program. The largest anti-poverty programs are Social Security (#1), EITC along with other refundable credits (#2), and SNAP (#3).

- TANF was introduced in 1996’s welfare reform (under President Bill Clinton). Between 1996 and 2002, partially due to TANF, overall welfare caseloads had dropped by 2.5M families (a decrease of over 50%).

- Certain poverty rates declined but then rose again, across the past 24 years. For example, between 1990 and 2000, the poverty rates for both single-mother and married family households with children declined overall, with the combined poverty rate for families with children going from 16.5% to 12.7%. Both rates started climbing again after 2000.

Terminology: Acronyms

Before getting into some of the recent trends for welfare statistics, for reference, here are some of the acronyms used elsewhere in this article.

- AFDC – Aid to Families with Dependent Children: succeeded by TANF in 1996.

- BLS – U.S. Bureau of Labor Statistics

- DOL – U.S. Department of Labor

- EITC – Earned Income Tax Credit

- FICA – Federal Insurance Contributions Act

- FNS – Food and Nutrition Service of the USDA

- FY – Fiscal Year

- L1HEAP – Low-Income Home Energy Assistance Program

- SNAP – Supplemental Nutrition Assistance Program

- SPM – Supplemental Poverty Measure

- SSI – Supplemental Security Income

- TANF – Temporary Assistance for Needy Families

- UI – Unemployment Insurance — in this case, the benefits paid to qualified people who are unemployed.

- USDA – U.S. Department of Agriculture

- WIC – Special Supplemental Nutrition Program for Women, Infants, and Children

Who is Getting the Welfare Benefits?

Every household collecting welfare benefits is not the same, and a misunderstanding of this sometimes leads to political debate. Here are some of the key groups who are or have collected welfare:

- Individuals

- Individuals, elderly (60+ years) or disabled

- Married couples

- Married families (couples with related children)

- Single mother with kids

- Single father with kids

- Child-only — where a parent may or may not be present, but if present does not collect any welfare benefits for a variety of reasons.

- Disabled or elderly individual with children (possibly as guardian)

- Family with disabled or elderly individual

- Multi-generational families

- Household of unrelated individuals where one or more people are collecting welfare benefits of some sort. E.g., students, roommates.

These are just some of the primary categories of households collecting welfare benefits.

The Trends: Successes and Concerns

Unfortunately, the way that the official poverty rate is defined, it may seem to some that the war on poverty has not been effective. Some of the reasons are:

- The poverty rate excludes “income” from SNAP, EITC and other programs.

- It does not factor child-care, out-of-pocket medical spending, and other expenses.

- The affordability-of-food measure is defined for a family of three for 1963 to 1964, and the only adjustment since is for inflation.The fact is, the Supplemental Poverty Rate (measured post-transfer of benefits to recipients) has actually dropped overall from 1967-2012. However, the traditional, official rate shows poverty to be mostly about the same in that time period, with small fluctuations up and down. This may partly be why critics claim that poverty rates have not changed despite all the welfare program expenditures.

Recent Welfare Trends

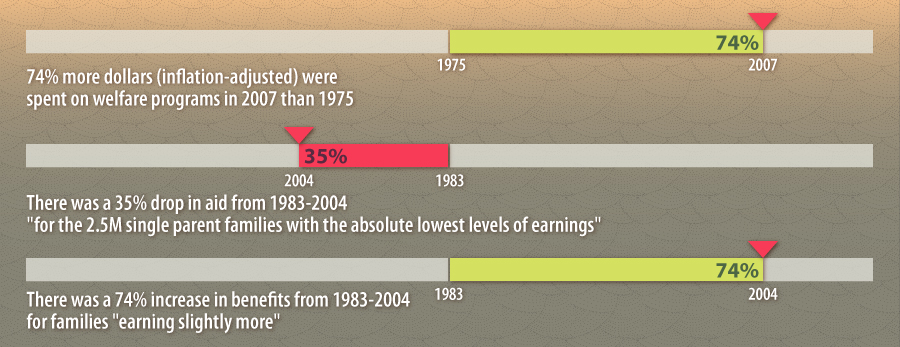

Robert A. Moffitt, the Krieger-Eisenhower professor of economics at Johns Hopkins University and president of the Population Association of America, has found some interesting trends regarding how the U.S. government supports low-income families. His findings — which will appear in full in the journal Demography in the Winter 2015 edition — covers 30 years of data for the “15 largest social safety net programs.”

Three Major Trends Moffitt Found

- Overall, people earning more are getting more benefits collectively, leaving lower-income families with less benefits. Those earning 200% above the federal poverty line are getting more aid than those earning 50% of the poverty line. So a family of four earning $11,925/year in 2014 will get less aid than a family of four earning $47,700/year.

- The disabled and elderly are getting more assistance than those who are neither.

- Married parent families are getting more assistance than single parent families.

Other findings by Moffitt

- The trend seems to be that welfare is going to those who are perceived as “deserving” of support, with having a job, being married and having kids being key factors.

- There was an average decline of about 20% in benefits from 1983 to 2004 for a non-disabled, single parent family for parents younger than 62.

- If such a family earned 50% below the poverty line, they actually saw an average 35% decline in the 1983-2004 time period. For similar families earning above 50% of the poverty line, they saw an average increase of 73% in benefits.

- The largest-growing welfare programs, such as SSI (Supplemental Security Income), EITC (Earned Tax Credit), CTC (Child Tax Credit), tend to benefit “only specialized populations.”

[Tweet “The largest-growing welfare programs, such as SSI, EITC & CTC, tend to benefit “only specialized populations.””]

According to Moffitt, “We see a pattern of rising support for those who work and declining support for those who do not. The decline of support to families with non-employed members and to single parents seems to be rooted in the presumption that they have not taken personal responsibility for their own situation.”

How SNAP is Helping the Welfare State?

Moffitt reported that SNAP — the USDA’s Supplemental Nutrition Assistance Program — only provides about $5 per day per person. However, according to CBPP (Center on Budget and Policy Priorities) reports and other sources, the program has helped fight poverty significantly.

- Nearly 5M (4.9M) Americans (including 2.2M children) were lifted above the poverty line in FY 2012 by SNAP payments – a record high between the years 1995-2012. This is compared to 2.5M people kept out of poverty in 2012 by UI benefits.

- An additional 1.4M children were kept above the 50% of poverty line by SNAP — more than for any other program.

- SNAP has also helped significantly decrease extreme poverty (people living on less than $2/day for food expenditures) in general.

- SNAP benefits are not just going to the unemployed. The number of SNAP households that have earnings has increased from about 2M in 2000 to 6.4M in 2011 — more than tripling in that period.

- Over all, over 46M (46.6M) people in over 22.3M households received SNAP benefits for FY 2012. The number was 49M people in 2011 and an estimated 47M for 2013.

- About 82% of the 22.3M SNAP households in 2012 had people living in poverty.

- 75% of SNAP households had a child (under 18), someone elderly (60+) or a “disabled non-elderly individual.” That translates to 45% of SNAP individual recipients being children, 9% elderly and 10% disabled adults.

- 2.1 people made up the average household size for FY 2012 SNAP recipients.

- SNAP is a “transition” benefit, often paid out to help individuals and families when unemployment benefits run out. According to FeedingAmerica.org and based on Sept. 2011 USDA data, “90% of SNAP benefits are redeemed by the third week of the month, and 58% of food bank clients currently receiving SNAP benefits turn to food banks for assistance at least 6 months out of the year.“

- SNAP eligibility is tight (gross income of no more than 130% of the federal poverty line).

- Payment error rates have declined from 8.91% in FY 2000 to 3.80% in FY 2011 – a record low at that point, and a decline in errors of about 57%. These errors are typically due to caseworker mistakes, and some are underpayments. SNAP’s accuracy rate is higher than for various Medicare benefits.

- SNAP costs for FY 2012 were $78.4B, comprised of $74.6B in benefit payments and $3.8B in administrative costs.

Despite the low error rate and tight eligibility, the SNAP program has been the target of the House Budget Committee, who wants to cut funding to SNAP by $137B over a ten year period (2015-2024). Other low-income assistance programs are likely to be cut as well.

How TANF is Helping

The older AFDC (Aid to Families with Dependent Children) program was succeeded by TANF (Temporary Assistance for Needy Families) under the 1996 welfare reform under President Clinton’s administration. The most significant recent change in TANF is that the work requirement was set aside in 2012.

- AFDC/ TANF recipients rose from 6.1M to 9.5M between 1970 and 1993.

- Overall, a smaller percentage of children in poverty are receiving TANF benefits — a drop of almost 2/3, from 1996 to 2012, inclusive.

- About 6.104M children received AFDC/ TANF benefits in 1970. For 2013, 3.072M million children received TANF benefits. The peak of 9.46M children was in 1993.

- 3/4 of TANF recipients in FY 2010 were children.

- 50% of 2010 TANF families had one child, 28% had two children.

- Child-only recipients made up 46% of 2010 TANF cases (parent(s) not eligible or not present).

- $327/month was the average cash payment to 2010 TANF families with one child. These families usually also received other non-cash benefits, including SNAP, subsidized housing or their children were in some way subsidizing — though not necessarily all of these benefits simultaneously.

- 31.9% of 2010 TANF families were African-American.

- 62% were white or Hispanic

- 6% were other.

Employment and Unemployment Rates of Welfare Recipients

A few years ago, the Cato Institute published a report which a number of welfare program critics have used to claim that there were more people on welfare in 2011 than were working. Unfortunately, some of the assumptions made in the report were erroneous, causing conclusions to be misleading and sometimes false. For example, government stats show that there were over 108M (108,592,000) people in the U.S. receiving payments from one or more “means-tested government benefit programs.” Simultaneously, there were under 102M (101,716,000) who worked full-time year round in 2011, in both private-sector and government jobs. This led critics to conclude that more people were on welfare than working, with 1.07 people supposedly getting government benefits for every 1.0 person working full-time year-round. This conclusion is incorrect, as these two numbers cannot be compared to each other, for several reasons:

- Some full-time workers are eligible for welfare. They’ll be counted both as working full-time and as on welfare.

- The count for full-time workers only includes individuals.

- The count for welfare includes all members of a household, whether working or not. This includes children under 18, students and non-students living in one household as roommates, elderly (60+) or disabled family members, as well as other household members even if they are working.

Bad News about the Demographics of the Welfare State

- Unemployment hit a level in 2010 not seen since the mid-1980s.

- The post-WWII long-term unemployment rate (those out of work 27+ weeks continuously) hit a recent high in FY 2010, exceeding 40% — not as high as around the early 1980s, but close.

- For Apr 2014, more than a third (35.3%) of the 9.8M people unemployed that month had been seeking work for over 26 weeks. (As a share of the entire labor force, that’s still more than 20% rate of long-term unemployment.)

Good News about the Demographics of the Welfare State

Fortunately, there’s also some good news, that more people are working and there are fewer cases of subsidies:

- The number of full-time workers for 2013 was just over 116M (116,267,000 — seasonally adjusted BLS data) — a increase of over 14M people from 2011.

- According to Politifact.com, as of Dec 2013, there were “at least 12.1M fewer cases of subsidized housing, food stamps, Medicaid and TANF (cash welfare) being claimed this year than in 2011.” So this further refutes welfare critics’ claims that American people would rather sit around and collect welfare than work.

- The job openings ratio has improved. Between 2009-10, the ratio of unemployed workers to number of job openings hit a high of nearly 7 (people looking for a job for every job opening). As of Apr 2014, this ratio has dropped to about 2.5 jobseekers per job opening.

- The unemployment rate dropped slightly, from 6.7% to 6.3% in Apr 2014, with 9.8M people unemployed. (This breaks down by race to: 5.3% White non-Hispanic, 11.6% African American, 7.3% Hispanic/ Latino.)

The Minimum Wage Discussion

There was a time, up until about the early 1970s, when a full-time minimum wage job was just sufficient enough to raise a small family. That’s no longer the case, and it’s tough in many parts of the country — if not all parts — for an individual alone to get by on minimum wage, let alone a family.

The current federal minimum wage rate is $7.25/ hour (at time of writing). This is a poverty wage even at full-time hours, because it totals $15,080/ year — $4K under the poverty line for a family of three. The federal minimum wage has not increased since 2007 (changing from $5.15/ hour to $7.25/ hr), and minimum wage earnings do not buy what they used to.

Workers who rely on tips get paid even less — $2.13/hour, which has stayed that way since 1991 — over 20 years. A federal minimum wage rate of $10.10/ hour is being proposed (the Fair Minimum Wage Act). If passed, here are some of the benefits:

- The minimum wage rate would be increased three times at $0.95/ hour each time, to $8.20/hr three months after the bill takes effect (if it passes), $9.15/hr one year after that, and finally $10.10/hr two years after.

- After the increase to $10.10 , the wage will change yearly, indexed to inflation.

- Tipped workers will start with $3.00/hour (three months after the bill is enacted), then get annual $0.85/hour increases up until 70% of the regular minimum wage.

- Increasing the minimum wage will create as many as 85,000 jobs.

- Working families will gain about an extra $100/ week at $10.10/hr.

- A minimum wage increase would considerably help women, given that an estimated 49.4% of the total workforce as of Jul 2015 will be female yet 56.0% of female workers will be positively affected by a higher wage. Men make up 50.6% of the workforce, though a wage increase will only help 44.0% of male workers, by comparison.

- The increase would also help older workers. Despite misconceptions, minimum wage workers are mostly 20+. 83.3% of workers by Jul 1, 2015, of 20+ years of age will be positively affected by a wage increase. The remaining 11.7% of minimum wage workers positively affected will be under 20 years of age in Jul 2015.

- The $10.10/hr figure for 2015 would grow the economy by an estimated $22B.

- This is expected to help around 28M American workers.

- 900K Americans will be above the poverty line as a result.

- Taxpayers would have a reduced burden because low-wage workers will then need less nutrition assistance. For example, it’s expected that a $10.10/hr wage will save $4.6B for SNAP per year — or $46B over 10 years.

- The United States’ largest employers of low-wage workers collectively make net profits of over 5 times that of the expected SNAP savings. 2013 net incomes: $17B WalMart, $5.59B McDonald’s, $3B Target, $1.09B Yum! Brands (Taco Bell, Pizza Hut, KFC).

SPM – Supplemental Poverty Measure

One of the problems with the official poverty rate, in use since the 1960s, is that it only looks at a family’s or individual’s cash income. A variety of legitimate family costs and resources are not factored in, including tax payments, and work expenses.

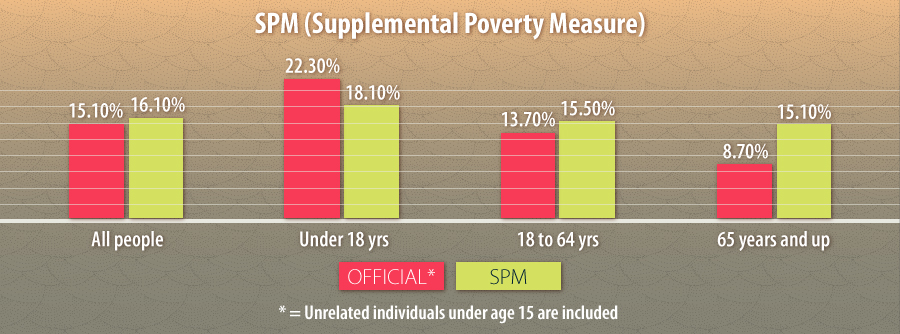

The SPM (Supplemental Poverty Measure) is a fairly new statistic, initiated in 2010, that incorporates tax payments, work expenses, and other factors. According to the Census Bureau, the SPM “will be adjusted for geographic differences in the cost of housing,” and will use “Consumer Expenditure Survey expenditure data on basic necessities (food, shelter, clothing, and utilities)” to determine thresholds.

It is not meant to replace the official poverty rate nor be used to determine eligibility for welfare programs, but rather “as an additional indicator of economic well-being.” The SPM is still “a work in progress” and its definition will likely be refined. For example, here is a table comparing the official poverty rate versus SPM for 2011, broken down by age groups.

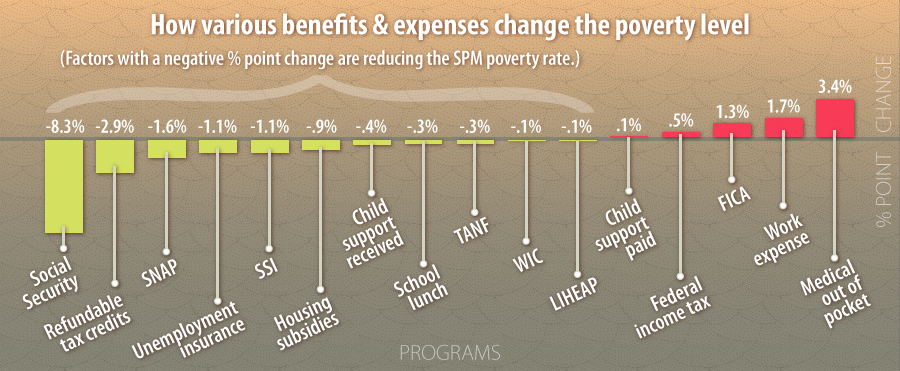

While the poverty rate actually looks worse under the SPM for some age groups, the measure makes it easier to determine the impact on poverty after certain benefits and expenses are factored in. Here is a table for 2011 showing how various benefits and expenses change the poverty level.

In other words, Social Security benefits reduced the SPM rate by 8.3 percentage points — meaning that for 2011, the overall SPM of 16.10% goes down to 8.07%, after factoring in Social Security benefits. Refundable tax credits reduce the SPM further by 2.9%, while SNAP reduces it by an additional 1.6%. Some of the factors do raise the SPM, and they are not accounted for by the traditional poverty rate. In total, all of the above factors collectively reduce the 2011 SPM rate by 10.1%, for a net measure of 6% — suggesting that the various benefits and welfare programs are effective in the war on poverty.

Related: